Platform Solutions

Your go-to platform solution for everything ESG and Sustainability risk management,

regulatory alignment, and best-practice sustainable Investing.

Regulatory Data

In a world of ever-evolving sustainability regulations, esgeverything simplifies the alignment of your investment strategies and periodic reporting needs, with comprehensive, all-in-one solutions.

SFDR Principle Adverse Impact (PAI) Indicators

- Comprehensive Data Access

Access all 16 mandatory PAI metrics across a large database of Equities, Corporate Bonds, Government & Supranational Bonds and Funds & ETFs; - Effortless Integration of PAI Scores

Leverage unique PAI scores for simple and effective consideration of PAI within ex-ante investment decision making; - Sustainable Framework Development

Build Do No Significant Harm frameworks in the context of

defining Sustainable Investments; - Robust Reporting and Compliance

Produce quality entity-level and portfolio-level PAI reports in line with SFDR disclosure requirements.

Sustainable Investments

The building blocks:

Access a variety of robust data and analysis, across instruments, to develop sustainable investment thresholds, in line with SFDR guidance.

With access to ESGeverything you can assess:

- Operational and Revenue alignment of investee companies with the 17 UN SDGs;

- Capex, Opex and Revenue alignment of investee companies with the EU Taxonomy;

- PAIs of investee companies, governments and supranationals, and how they score relative to the universe and their sector;

- SBTi Targets of Investee companies;

- Good Governance practices of investee companies, countries and supranationals;

- Robust ESG and Sustainability Due-Diligence Ratings across our large database of Funds and ETFs.

- Granular Green, Social and Sustainability Bond ESG Ratings and Use of Proceeds.

The Analysis:

Assess the percentage of sustainable investments within your portfolio in line with regulatory best-practice and MainStreet Partners’ stringent proprietary methodologies.

MiFID II

With one of the largest collections of EET data across over 400+ Asset Managers, we enable FMPs to easily and efficiently align product offerings to client sustainability preferences.

EU Taxonomy

Identify the percentage alignment to the European Taxonomy of companies based on Turnover, CapEx and OpEx, against the six Environmental Objectives.

Today, through the latest AI and machine learning technology, we extract raw data directly from company reports, saving you valuable research time as disclosure rates evolve.

To provide deeper insights into decarbonization efforts, alignment is further categorized into:

- Enabling Activities;

- Transitional Activities;

- Transitional Activities covering energy generation via Nuclear and Gas.

These classifications highlight the role of companies in advancing the EU’s sustainability goals.

The solution is designed to provide maximum value to our clients – you can now account for a larger scope of securities and provide even more accurate regulatory insights thanks to.

Our fund look-through capability, based on over 8 years’ experience in the Sustainability Due Diligence of Investment Funds;

MainStreet’s project-level analysis of Green and Sustainability Bonds – providing you with greater and more robust Alignment, even for Sovereign and Supranational bonds – thanks to our 10+ years’ experience and cutting-edge research in this market.

What to expect from this data package?

- Data Quality: Standardized data across corporate entities ensures consistent and reliable comparisons;

- Idea Generation: Identify companies strategically positioned for the transition to a sustainable economy;

- Regulatory Compliance: Meet your sustainability disclosure obligations with confidence.

UK SDR

MainStreet Partners has a unique and robust approach to the ESG and Sustainability rating of Funds & ETFs, with over 6 years of experience in providing ESG focused due-diligence assessments. Our methodology entails an in-depth analysis of the:

- Asset Management Firm

- The Fund’s Strategy

- Regulatory Adherence to SDR anti-greenwashing rules

- Fund Portfolio

MainStreet Partners has a dedicated Sustainable Fund Research team that conducts an independent factor-based assessment on a large scope of Funds, with a proven track record and expertise in ESG.

How does this help UK FMPs?

- Assess a fund’s sustainability objectives, the evidence-based absolute measure of sustainability and that the underlying assets do not conflict with this sustainability objective (as required by the FCA)

- Identify potential greenwashing risk

- Identify weak and strong sustainability strategies enabling investors to mitigate ESG risks and seize sustainable investment opportunities.

ESG and Sustainability Risks

Manage ESG and Sustainability risks with ESG and Sustainability ratings and analysis, based on robust proprietary methodologies across Equities, Funds, ETFs, Fixed Income and labeled Fixed Income instruments.

Equity and Corporate Bond ratings

- Our corporate ESG and Sustainability ratings have been developed to offer an accountable solution for professional investors to assess the ESG resilience of a broad and continuously growing universe of corporate issuers. Our proprietary model uses 200+ metrics to determine each investee company’s performance on the material Environmental, Social and Governance factors, taking double materiality into account.

Funds, ETFs and Index ratings

Our Fund ratings are industry-renowned, based on a thorough ESG and Sustainability due-diligence assessment across an extensive universe of Funds, ETFs, and Index Funds.

MainStreet Partners’ unique methodology involves a 3-pillar approach, examining

- The overall asset management firm;

- The fund’s strategy;

- The underlying portfolio;

What sets us apart?

- This holistic approach transcends typical fund ESG ratings, giving insight into how sustainability of a fund is integrated from the Asset Management level through to portfolio manager strategy and investment decision making;

- We’ve developed a 85+ factor-based scorecard that meticulously evaluates each fund;

- MainStreet conducts high-level engagement with third-party fund managers, ensuring a deeper understanding of their sustainability profile and any greenwashing risks.

Government & Supranational Bonds

At MainStreet Partners, we evaluate government and supranational bonds across 131 countries and 51 Supranational bodies using a holistic approach.

- Our proprietary model assigns scores based on a country’s demonstrated improvement in ESG and Sustainability performance over time, rather than solely focusing on single-period evaluations;

- This dynamic scoring mechanism rewards countries that have made significant strides in enhancing their sustainability practices and governance frameworks over the years;

- With 86 sub-indicators mapped across Environment, Social, Governance and Macroeconomic pillars, our methodology provides insightful and data-driven assessments on a country’s ESG and Sustainability risk and long-term sustainable growth and prosperity.

Green, Social, Sustainability and Sustainability Linked Bonds

Access to a substantial universe of bonds, including but not limited to:

Carbon Footprint: calculation of the carbon footprint of labelled bonds helps measuring and managing carbon emissions covered by CO2 targets of investments – yielding higher accuracy and improved “transition” results;

ESG and Sustainability Ratings: provide investors with the necessary tools to assess sustainability risks. GSS Bonds ratings rely equally on the Issuer’s ESG Rating and on the specific sustainability assessment of the GSS Bond;

Impact Results: KPIs based datapoint on publicly available data extracted from official sources provided by the issuers, verified and standardised;

SDGs Alignment: mapping to the UN Sustainable Development Goals based on pre-issuance and post-issuance allocation of proceeds;

Use of Proceeds: data reported on the use of capital, both in terms of project types and of geographical location.

Controversies and Exclusions

MainStreet Partners has built and continuously maintains a list of companies that generate revenue from, or are otherwise exposed to, activities that have adverse impacts on the environment and society – enabling you to identify and screen those involved in controversial sectors like weapons, gambling, Arctic drilling, and oil sands.

Exclusionary Screening

Identify and screen companies that are involved in controversial activities such as Controversial Weapons, Gambling, Arctic Drilling, Oil Sands and Oil Shale.

MainStreet Partners has built and continuously maintains a list of companies exposed to activities that generate revenue, or are exposed, to activities that have adverse impacts on the environment and society.

Our structured process and flexibility of our tool empowers investors to:

- Create bespoke Exclusion lists according to in-house exclusion policies or % revenue thresholds across 13 activities;

- Monitor client portfolio exposure to controversial activities;

- Screen out companies exposed to controversial activities from investable universes;

- Analyse the % exposure of third-party Funds and ETFs to controversial activities.

Controversial Behavior

MainStreet Partners identifies companies with high-risk behavior associated with negative impacts on the environment, society, community, or company reputation.

Our robust assessment framework evaluates the severity of these events based on Scale, Frequency, Response, Effectiveness, and Transparency of the company.

How does esgeverything help?

- From Human rights violations to Environmental damage, MainStreet Partners covers a wide range of topics;

- Monitor each company’s involvement in yellow flag (medium risk) or red flag (high risk) controversial events, to go one step further in managing ESG and Sustainability risks of your investments;

- Identify third-party Funds and ETFs exposure to red flag controversial events, and the material contributors.

ESG and Sustainability analysis and non-financial reporting solutions

Simply upload your portfolio to instantly receive a thorough ESG and Sustainability analysis, empowering you to make informed decisions with ease.

Portfolio analysis and non-financial reporting solutions

Our platform enables you to effortlessly upload your portfolios with a single click, delivering a comprehensive ESG and Sustainability analysis within seconds. Whether you’re addressing regulatory compliance or fulfilling commercial reporting needs, our solution provides fast, detailed, and actionable insights tailored to your specific requirements.

Simply upload your portfolio to instantly receive a thorough ESG and Sustainability analysis, empowering you to make informed decisions with ease.

Impact Data

Harness high-quality data to gain granular insights into a company’s alignment – both positive and negative – to each of the 17 UN Sustainable Development Goals.

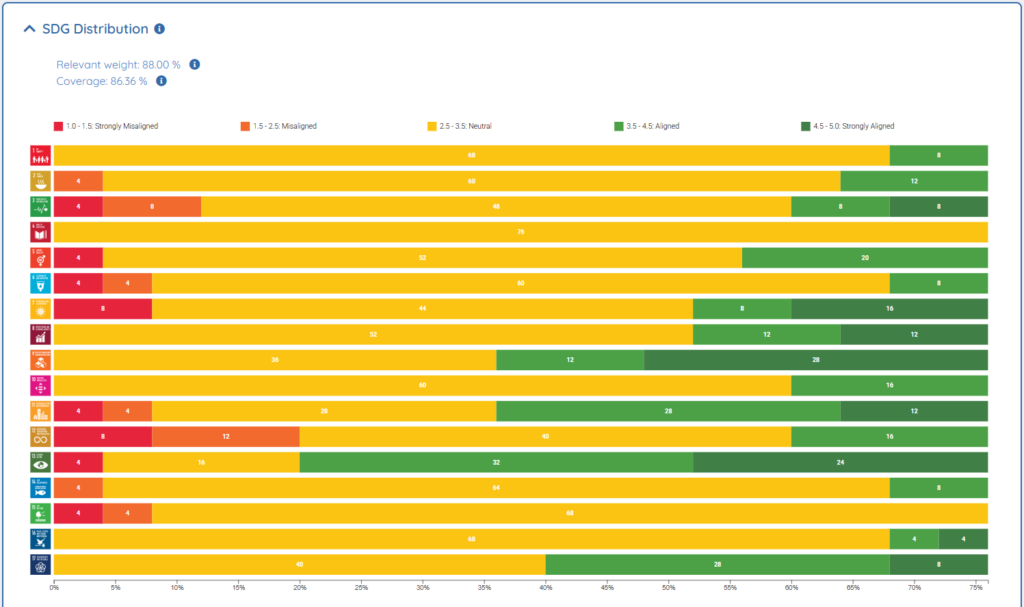

Sustainable Development Goals

MainStreet Partners is a leader in SDG alignment data, supporting investors in building thematic solutions and measure the sustainability of their portfolios for over 7 years.

For us, alignment goes beyond just what a company does; it’s equally about how they do it. Thus, we have pioneered a comprehensive methodology that evaluates alignment through three distinct lenses:

- Operational Alignment

- Product Alignment

- Business Behaviour

Why is this important?

- Build sustainable investment portfolios that are aligned with sustainable and impact objectives;

- Unlock investment opportunities by identifying companies contributing to key growth markets;

- Allocate capital toward addressing some of the world’s most pressing challenges;

- Meet client sustainable preferences by aligning their portfolios to their sustainability goals;

- Report and measure SDG alignment of portfolios.

esgeverything provides full access to our high-quality and granular SDG Alignment datasets.