Exclusions and Controversial Behaviour monitoring

With global regulatory landscapes ever-evolving, ESGeverything is equipped to streamline your ESG due-diligence and regulatory compliance, with simple solutions, that are all in one place.

With global regulatory landscapes ever-evolving, ESGeverything is equipped to streamline your ESG due-diligence and regulatory compliance, with simple solutions, that are all in one place.

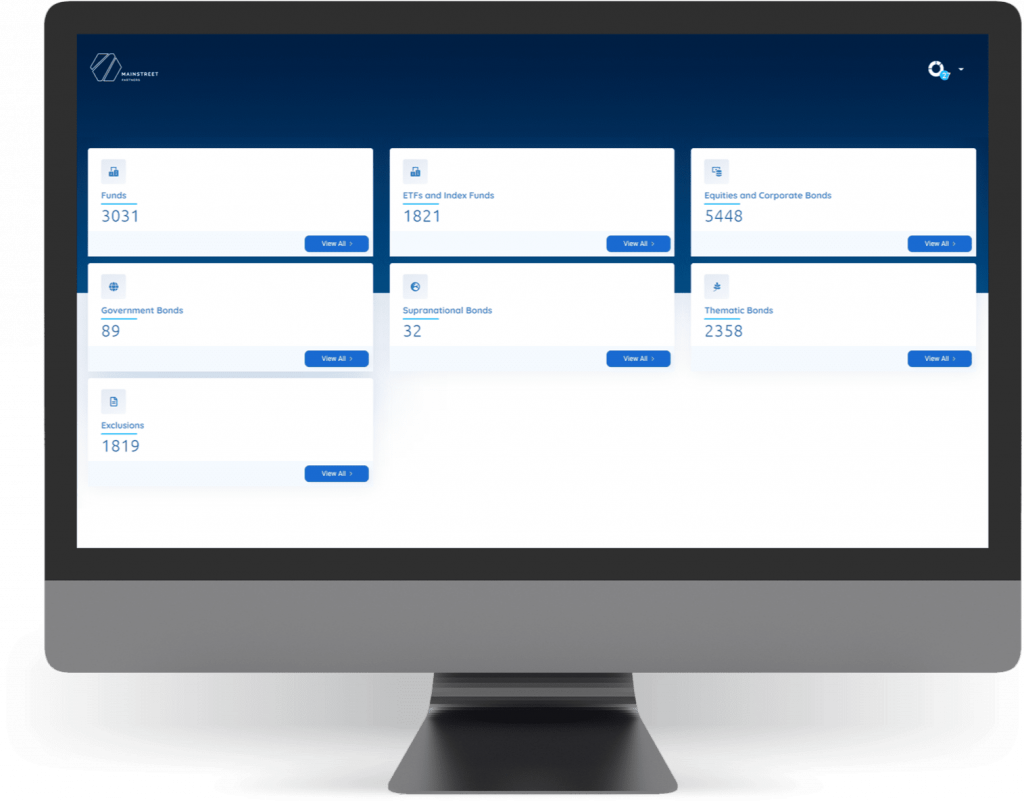

Managing your sustainability risks has never been so straightforward, with ESG analysis offered across equities, multi-asset funds, ETFs & Index funds and corporate, government, supranational and thematic bonds.

With global regulatory landscapes ever-evolving, ESGeverything is equipped to streamline your ESG due-diligence and regulatory compliance, with simple solutions, that are all in one place.

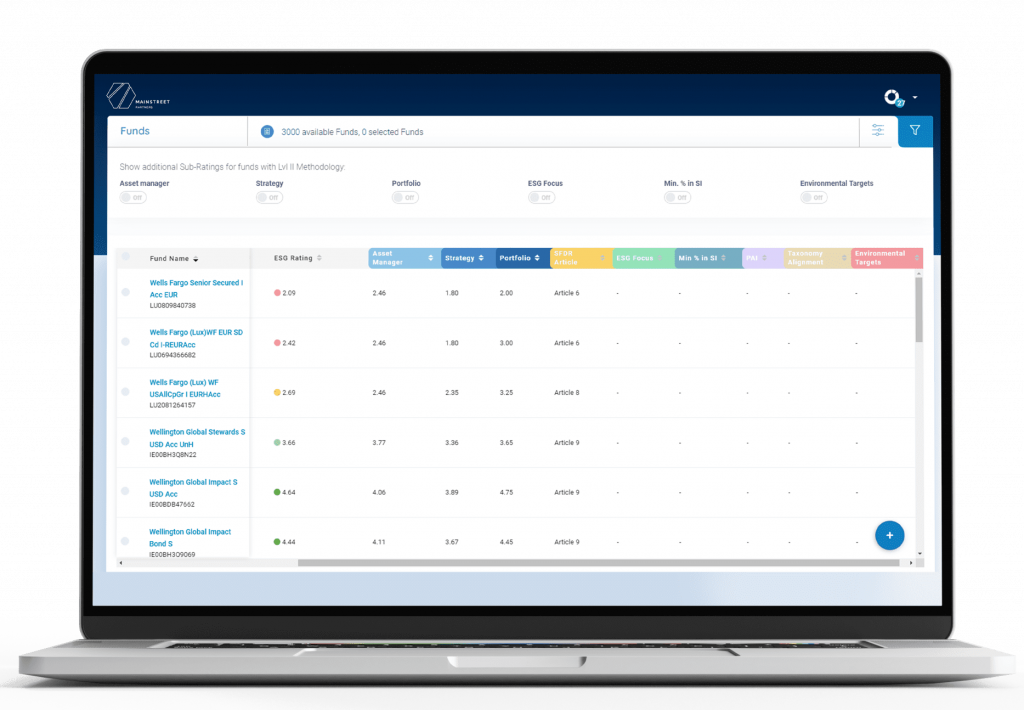

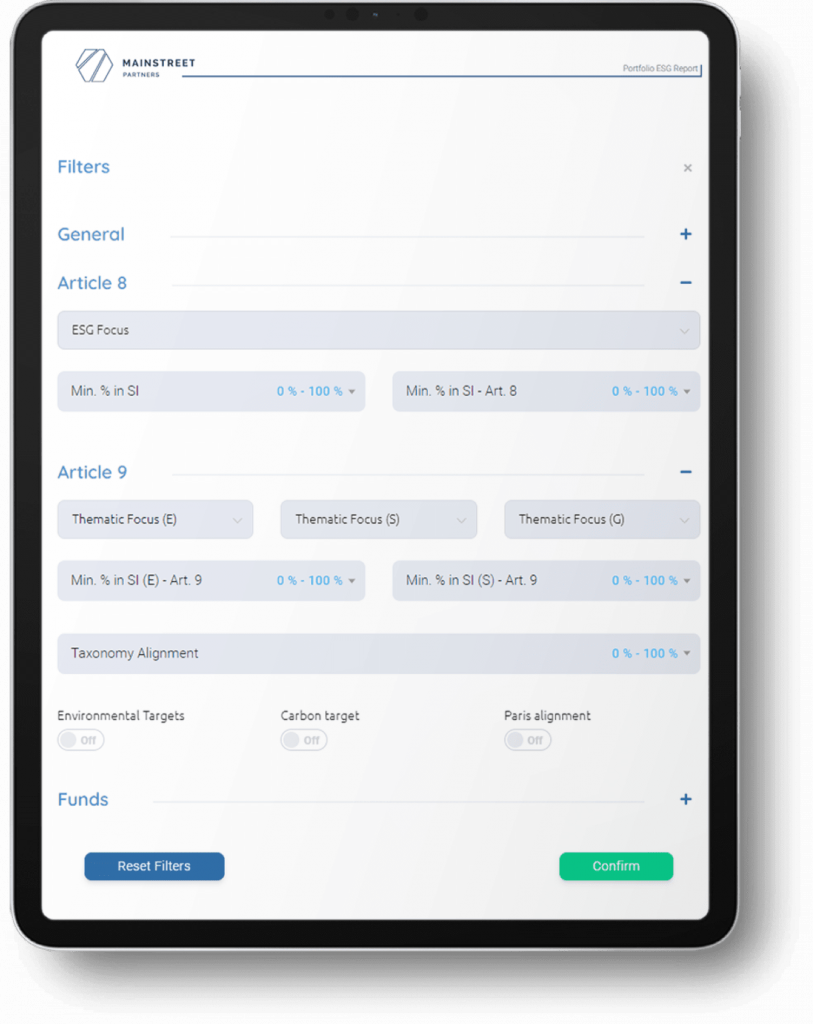

ESGeverything’s portfolio analysis tool is where we bring life to all platform solutions Offering an invaluable way to gain a ‘sustainable oversight’ of your entire portfolio and enhance your ESG reporting and regulatory compliance with the click of a button.

With global regulatory landscapes ever-evolving, ESGeverything is equipped to streamline your ESG due-diligence and regulatory compliance, with simple solutions, that are all in one place.

• SFDR Article

• ESG Focus

• Thematic Focus (E)

• Thematic Focus (S)

• Thematic Focus (G)

• Min. % in SI

• Min. % in SI (E) – Art. 9

• Min. % in SI (S) – Art. 9

• PAI

• Taxonomy Alignment

• Environmental Targets

• Carbon target

• Paris alignment

Managing sustainability risks has never been so straightforward, with ESG analysis across equities, multi-asset funds, ETFs & Index funds and corporate, government, supranational and thematic bonds.

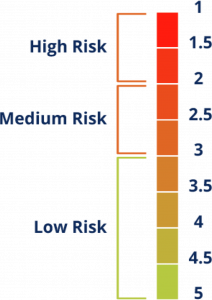

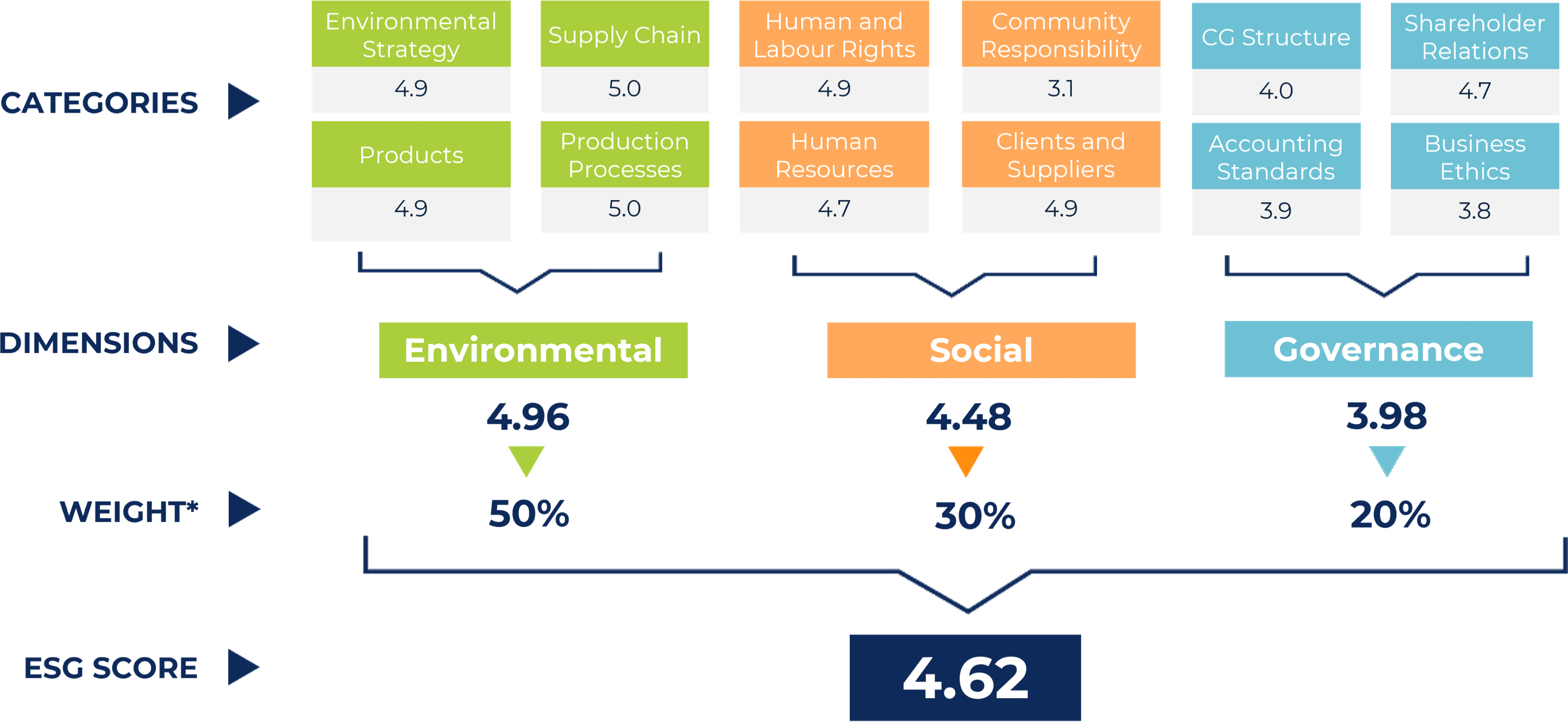

Aligned with disclosure requirements provided by the EU Sustainable Finance Action Plan, our ratings produce a final sustainability score from 1 to 5, which is homogeneous across all financial instruments. Updated monthly, our ratings aim to present an accurate and up-to-date reflection of the corporate’s true sustainability profile, with events of controversial and/or positive behaviour factored into the ratings model as they occur.

Our

corporate ratings have been developed to offer an accountable solution for

professional investors to navigate the ESG resilience of over 5000 corporate

issuers.

Our proprietary model uses 200+ metrics, with the data sourced directly

from both specialist providers and the corporates themselves.

These end scores

are determined by each company’s performance on the material ESG indicators which

MainStreet groups into 4 key parameters under each pillar of E, S and G. Sector

specific weightings are considered in finalising scores to ensure materiality.

Technicals aside – MainStreet Partners' independently-driven rationale resides in our mission to direct capital flows towards truly responsible activities, and for investors to manage ESG risks simply, consistently, and efficiently.

For our detailed methodology click here

or request a demo

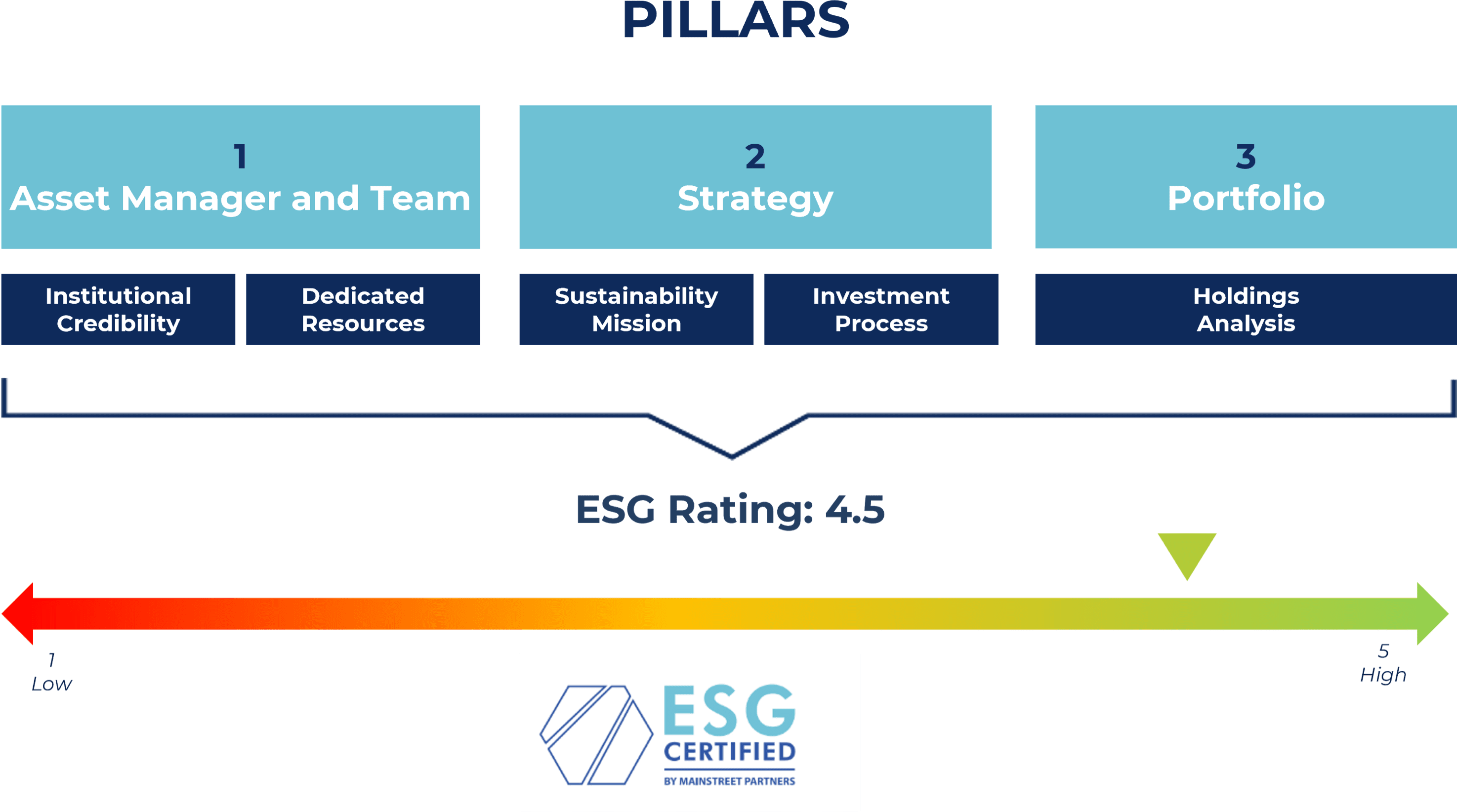

Our Fund ratings are well-respected in the industry, representing a robust sustainability assessment of over 5000 core funds, ETFs and index funds – and over 60,000 fund ISINs. MainStreet Partners’ unique methodology involves a 3-pillar approach which considers

.01 The overall asset management firm

.02 The fund’s strategy

.03 The underlying portfolio.

This is a holistic approach that goes above and beyond your typical fund rating, offering a trusted solution for ESG due-diligence and regulatory compliance. In identifying 80+ material KPIs, we have developed a scorecard that outlines the evaluation of each fund’s ESG performance, of which involves high level engagement with third-party fund managers. In doing this, we go one step further in gaining insight into the core reality of the fund manager’s sustainability profile, eliminating greenwashing risk once and for all. Alongside fund ratings, we provide additional key information needed to meet all EU regulatory compliance requirements.

For our detailed methodology click here

or request a demo

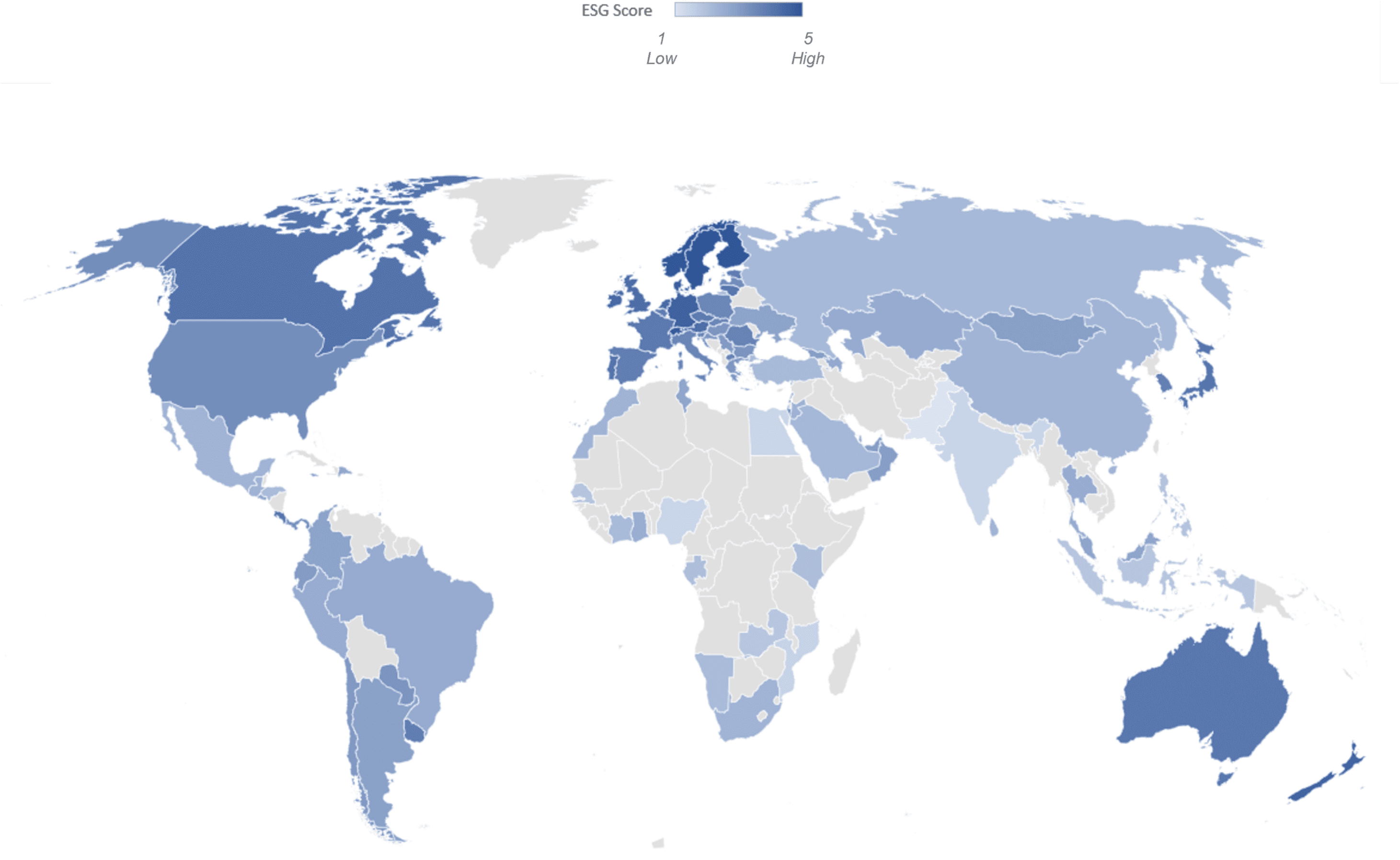

Our country ESG ratings evaluate a country’s performance on material environmental, social and governance concerns for 89 countries,

and 32 supranational bodies.

Not only does this analysis allow you to extend ESG risk analysis across your portfolio but will also provide you with valuable insight into the country’s long-term sustainable growth and prosperity.

Our country model takes a holistic approach, capturing a country’s current performance and incorporates positive/negative trends over the past decade. The model therefore gives a higher score to countries who have showcased significant improvement in performance over the last decade relative to single period improvement. 86 sub-indicators make up the foundation of this model, being mapped out, based on materiality weighting, into the four pillars Environment, Social, Governance and Macroeconomic.

For

our detailed methodology click here

or request a demo

With one of the largest thematic bond databases in the market, MainStreet Partners offers a powerhouse solution for assessing the sustainable profile of nearly the entire global stock of Green, Social and Sustainability (GSS) bonds.

Our

comprehensive methodology makes this a one-of-a-kind tool for asset owners and

managers to optimise their sustainable portfolios, with analysis covering

sustainability metrics of both the issue-specific level and the issuer-level.

The issue-specific assessment, where our true specialty lies, is comprised of the

bond framework analysis and analysis of the use of proceeds additionality. The

sustainability of the bond framework set of metrics aims to capture the level of

governance in place for the specific bond. The Use of proceeds additionality set of

metrics aims to capture the quality of the underlying projects financed by the bond,

as well as the financing mechanism utilised.

The issuer specific analysis is determined according to our in-house corporate ESG

ratings model for corporate GSS bonds, and similarly, the country ESG rating model

for government and supranational GSS bonds.

For

our detailed methodology click here

or request a demo

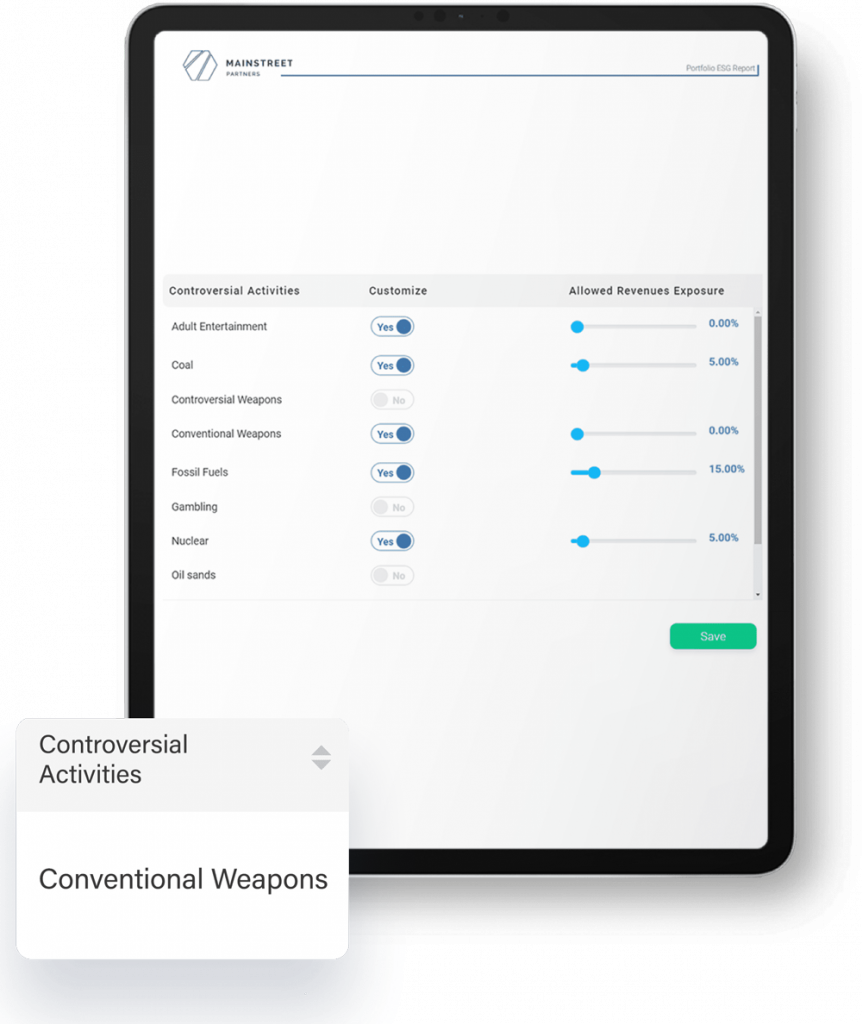

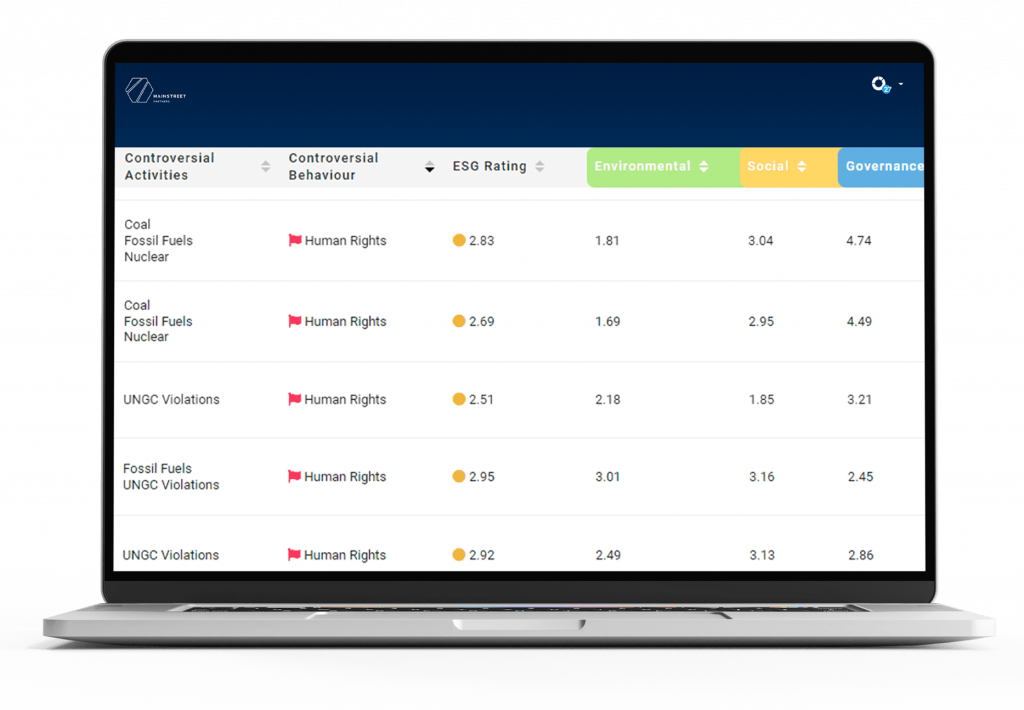

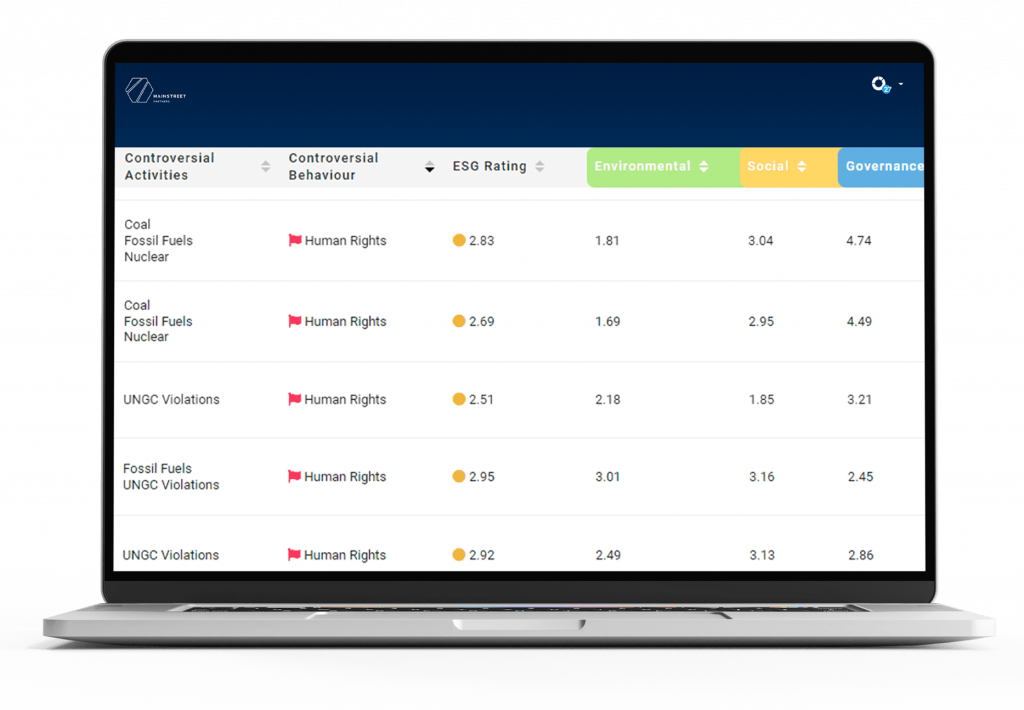

MainStreet Partners has built and continuously maintains a list of companies exposed to controversial activities, using a multi-step analysis, based on a proprietary taxonomy, and structured process.

Controversial activities are defined as all those operations in sectors that generate high reputational and financial risk, and could consequently, severely negatively affect the future financial performance of the company. Gambling, tobacco, controversial weapons, and fossil fuels are among many other examples of controversial activities we consider. Our tool makes it possible to screen out evidently unsustainable companies from clients’ investible universe and from third-party portfolio, generating different controversial activities lists according to clients’ particular preferences and revenue exposure tolerances.