Use Cases

Empowering ESG and Sustainability Excellence

Our range of solutions at esgeverything empowers financial institutions, asset managers,

and corporations with the tools and insights necessary for effective ESG data management, compliance, and impactful decision-making. Here’s an overview of our key solutions and how they add value to our clients.

esgeverything & Sustainability Navigator

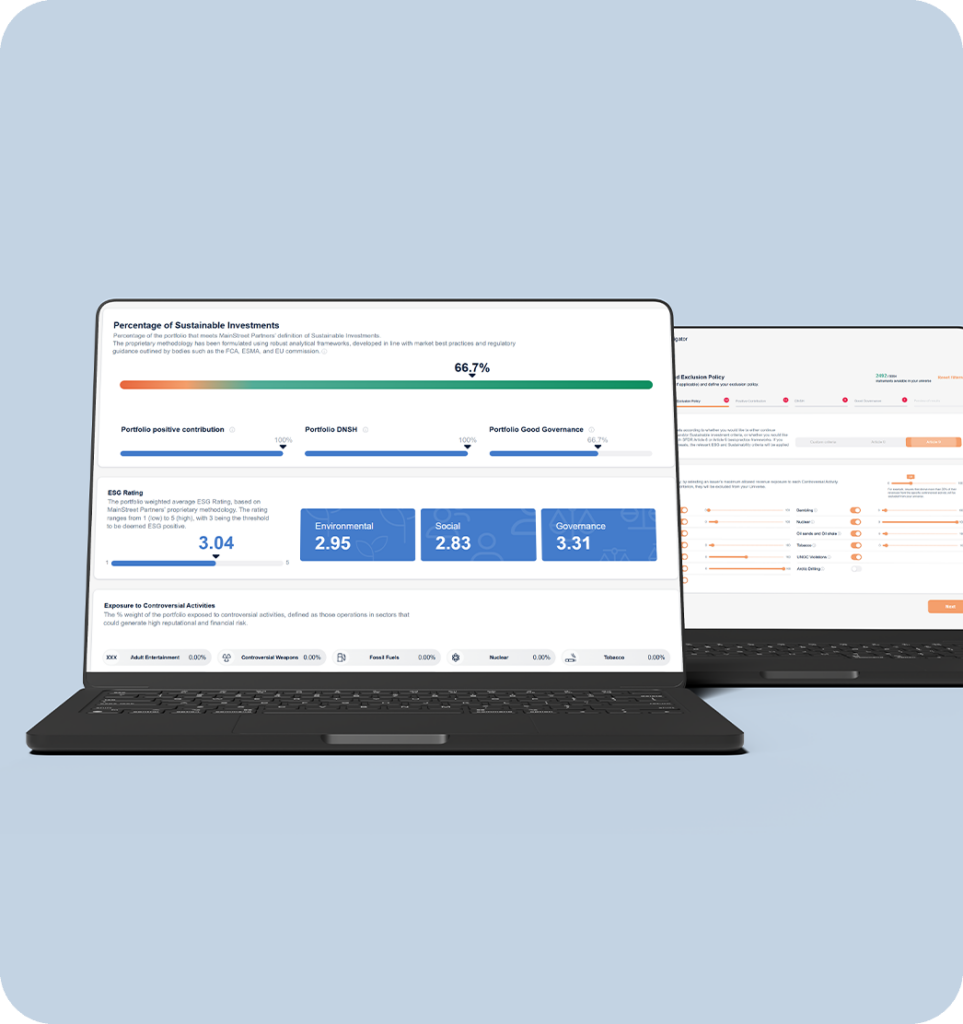

The esgeverything platform, combined with our Sustainability Navigator, provides a comprehensive and cost-effective solution for all ESG data needs. This user-friendly platform brings all essential ESG data into one accessible place, offering robust insights and data ratings across various asset classes.

Comprehensive Access

An easy-to-use solution that consolidates all necessary ESG and Sustainability data in a single, accessible platform.

Broad Data Coverage

Includes ESG and Sustainability ratings across Equities, Corporate Bonds, Funds, ETFs, Index Funds, Government & Supra entities, rated on a scale of 1 to 5.

Advanced Analytical Tools

Enables the building and analysis

of Sustainable Investment universes, tailored to specific

investment objectives.

Medium-Sized Bank with In-House Product Manufacturing

Client Need

The bank required access to ESG and Sustainability data to meet regulatory requirements and complement their existing ESG data providers.

Solution

MainStreet Partners provided access to the esgeverything platform and Sustainability Navigator, allowing the bank to access comprehensive ESG and Sustainability datasets at a security level.

Results

The bank significantly enhanced its sustainability credentials while ensuring compliance with sustainability regulations.

GSS Bond Data and Impact Reporting

Our GSS Bond Data and Impact Reporting solution offers the most comprehensive Green, Social, and Sustainability (GSS) Bond database in the market, backed by a decade of reliable and accurate data. This solution is designed for institutions looking to enhance their impact reporting capabilities across their portfolios.

Market-Leading Database

The most extensive GSS Bond database in the industry, providing data with unmatched granularity, quality, and reliability since 2010.

Customisable Reporting

Offers ad-hoc impact reports, enabling tailored insights for both portfolios and specific entities.

Large Asset Manager

Client Need

A large asset manager with over $10 billion AuM in green bonds aimed to expand its GSS Bond dataset for impact reporting and firm-wide fund management.

Solution

MainStreet Partners enabled access to our GSS Bond impact data, providing a comprehensive dataset for company-wide use.

Results

The asset manager could scale its GSS dataset without increasing headcount, producing detailed impact reports that supported fundraising efforts for its Green Bond Fund.

Regulatory Data and Reporting

Our Regulatory Data and Reporting solution addresses specific regulatory requirements, particularly under the Sustainable Finance Disclosure Regulation (SFDR). This pragmatic tool provides structured data and tailored reports that help clients stay aligned with evolving regulatory standards.

Focused Regulatory Support

A simple, practical approach to meeting SFDR and other regulatory requirements cost-effectively.

Pre- and Post-Investment Data

– Ex-Ante: PAI (Principal Adverse Impact) data at the issuer level.

– Ex-Post: Detailed PAI reporting at entity and portfolio levels, including taxonomy-aligned data.

Streamlined PAI Scores

Provides easy-to-implement PAI scores (1-5) to help portfolio managers align with DNSH (Do No Significant Harm) criteria.

EU Taxonomy Alignment

Our platform is one of the few that offers issuer-level taxonomy data, facilitating precise alignment calculations to support CSRD requirements.

Medium-Sized Bank – CSRD Compliance and EU Taxonomy Alignment

Client Need

The bank required data to calculate its alignment with the EU Taxonomy Regulation for compliance with the CSRD.

Solution

MainStreet Partners provided access to issuer-level taxonomy data, enabling the bank to assess its EU Taxonomy alignment. Our solution was competitively priced, providing a cost-effective choice compared to other providers.

Results

The bank successfully calculated its EU Taxonomy alignment, preparing for CSRD reporting well

in advance of regulatory deadlines.

Why Choose esgeverything

Our solutions are designed to integrate seamlessly into your existing workflows, providing the insights and data needed to make informed ESG and Sustainability investment decisions, meet regulatory obligations, and achieve sustainability objectives.

With over a decade of experience in ESG and Sustainability data management and reporting, we support clients across sectors, ensuring they are equipped for the challenges of sustainable finance.