Regulatory Data

In a world of ever-evolving sustainability regulation, ESGeverything simplifies alignment of your investment strategies and periodic reporting needs, with comprehensive, all-in-one solutions.

SFDR Principle Adverse Impact (PAI) Indicators; Sustainable Investment; MiFID II; EU Taxonomy; UK SDR

SFDR Principle Adverse Impact (PAI) Indicators

Principle Adverse Impact Indicators (PAIs) are a set of sustainability metrics that financial market participants are required to disclose periodically, under EU’s SFDR.

How does ESGeverything help you?

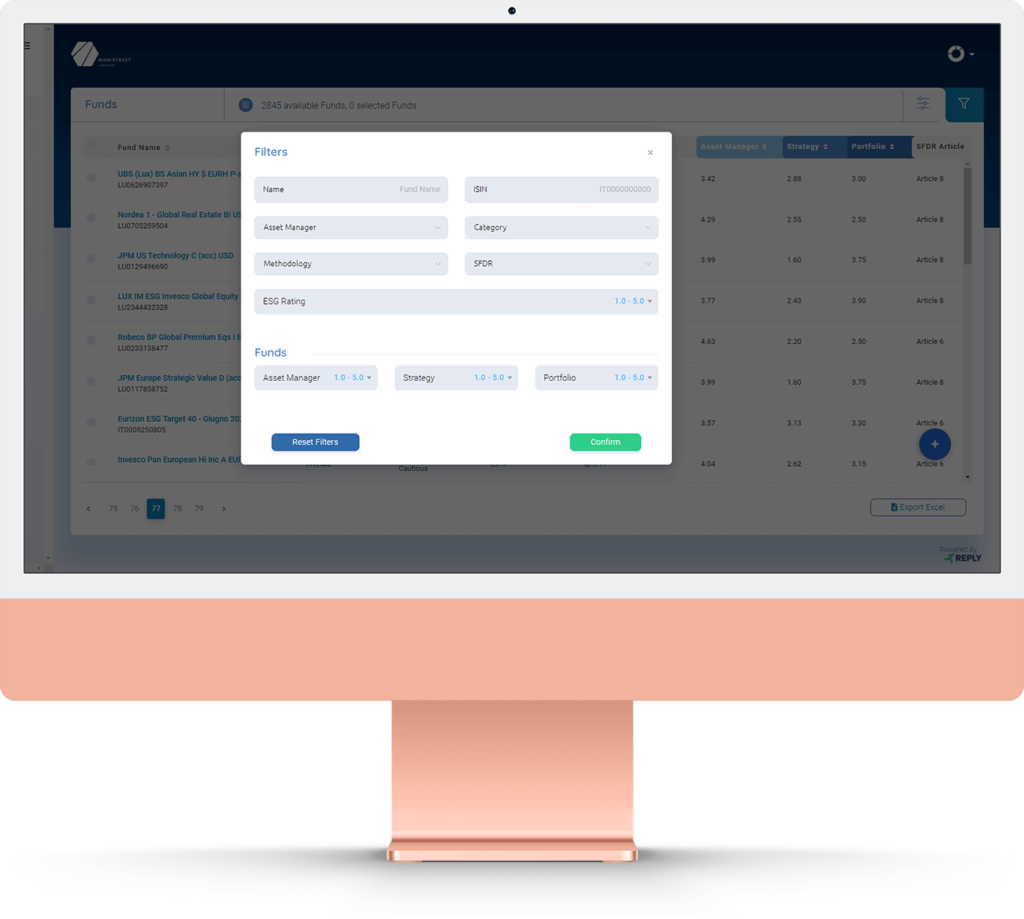

- Access all 16 mandatory PAI metrics across a large database of Equities, Corporate Bonds, Government & Supranational Bonds and Funds & ETFs.

- Leverage unique PAI scores for simple and effective consideration of PAI within ex-ante investment decision making.

- Build Do No Significant Harm frameworks in the context of defining Sustainable Investments.

- Produce quality entity-level and portfolio-level PAI reports in line with SFDR disclosure requirements.

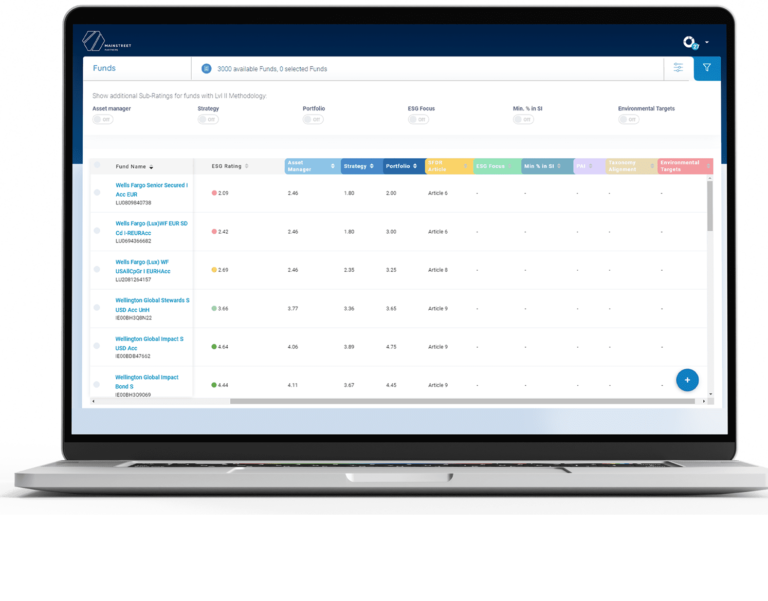

MiFID II

With one of the largest collections of EET data across over 400+ Asset Managers, we enable FMPs to easily and efficiently align product offerings to client sustainability preferences.

EU Taxonomy

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Identify the percentage eligibility and alignment of companies to the EU Taxonomy based on:

- Turnover – in monetary value and as a percentage of the company’s total;

- CapEx – in monetary value and as a percentage of the company’s total;

- OpEx – in monetary value and as a percentage of the company’s total (if relevant).

Through advanced AI and machine learning technology, we extract this data directly from company reports, saving you valuable research time as disclosure rates evolve.

- Data Consistency: Standardized data across corporate entities ensures consistent and reliable comparisons.

- Sustainable Investing Alignment: Identify companies strategically positioned for the transition to a sustainable economy.

- Regulatory Compliance: Meet your sustainability disclosure obligations with confidence.

UK SDR

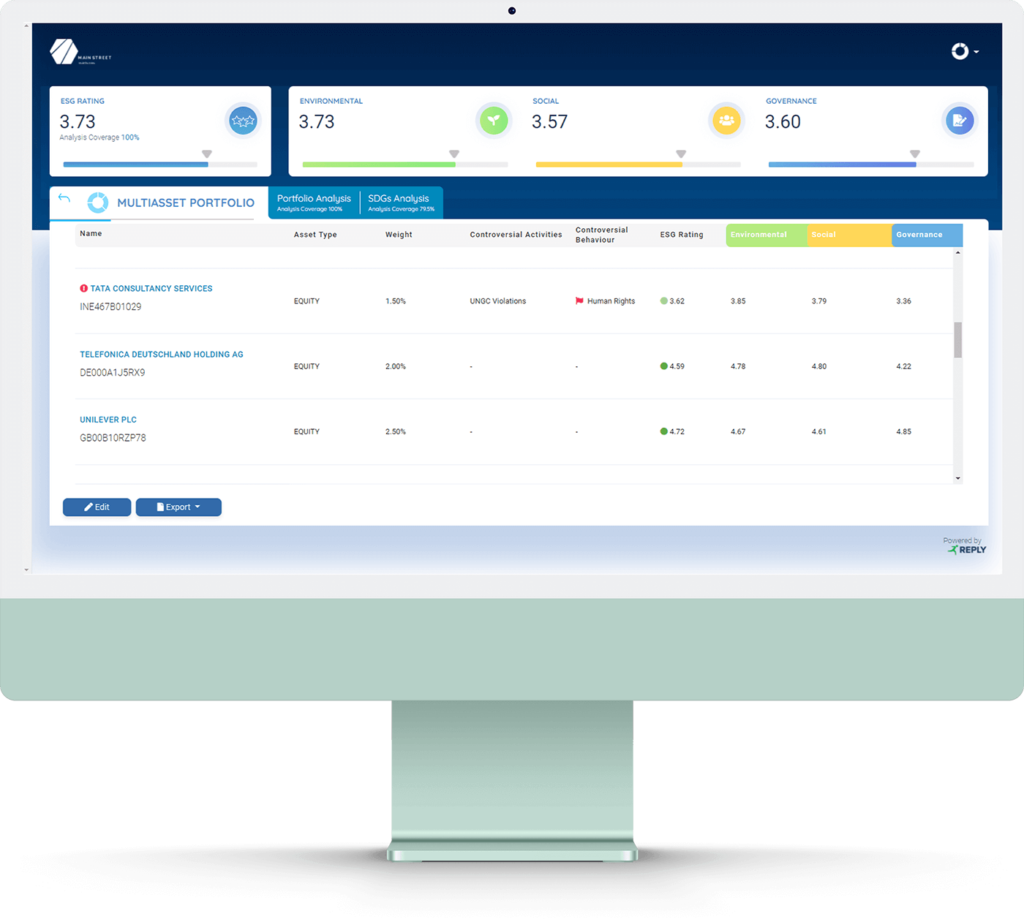

MainStreet Partners has a very unique and robust approach to the ESG rating of Funds & ETFs and so over 6 years of experience in providing ESG focused due-diligence assessments. Our methodology entails an in-depth analysis of the:

-

- Asset Management firm

-

- The Fund’s Strategy

-

- Regulatory Adherence to SDR Anti-greenwashing rules

-

- Fund Portfolio

MainStreet Partners has a dedicated Sustainable Fund Research team that conduct an independent factor based assessment on a large scope of Funds, with a proven track record and expertise in ESG.How does this help UK FMPs?

- Fund Portfolio

-

- Assess a fund’s sustainability objectives, the evidence-based absolute measure of sustainability and that the underlying assets do not conflict this sustainability objective (as required by the FCA)

-

- Identify potential greenwashing risk

-

- Identify weak and strong sustainability strategies enabling investors to mitigate ESG risk, and cease sustainable investment opportunities.