The rapid rise of investment funds specifically targeting the UN Sustainable Development Goals (SDGs), has not translated into a focus on geographically where those funds are flowing.

As finance services co-opted the SDGs – a blueprint of 17 interlinked global objectives to protect People and Planet by 2030 – from government policymakers, so new financial instruments were introduced. The first ‘Green Bond’ was launched in 2008 by the World Bank and Green, Social and Sustainability (GSS) Bonds have subsequently flourished into a $3.5trn market, to go some way to meeting the estimated $2.5trn annual funding gap required to hit the UN’s 2030 target.

Emerging Markets Beneficiary

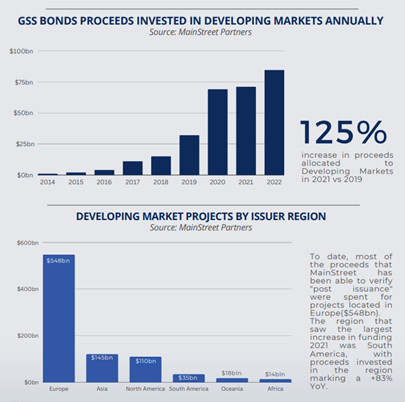

Our latest GSS Bond report found that regardless of the geographic location of a GSS Bond’s issue, the proceeds are increasingly being directed towards Emerging Markets. ‘Use of proceeds’ refers to the projects or activities being funded by the bond in order to address or mitigate a specific social or environmental issue. So, our latest GSS Bond report highlights that sustainable fixed income securities are increasingly being used where the project or activity is based in an Emerging Market.

This is big – and important – news. Why?

Because the targets set by the Paris Agreement and the SDGs can only be met if both Developed and Developing Market stakeholders work collectively towards their advancement. While investors are expected to play a significant role, cross-border financing of SDG-linked investments had been falling in most recent years. Global foreign investment flows, a key source of funding for Developing Markets, were under significant pressure during the pandemic, and fell 42% in 2021 compared to 2019.

Supranational entities often use GSS Bonds to support capital investments internationally, and especially in Developing Markets. The relationship between the country of domicile and the location of investment is not always clear-cut, but capital channelled towards Developing Markets has been steadily rising since 2016, as issuers and investors increasingly embraced the aim of building up climate financing in the most vulnerable regions established with the Paris Agreement in 2015.

There has been a 125% increase in proceeds allocated to Developing Markets in 2021 compared with 2019, and South America saw the largest increase in ‘use of proceeds’ to its impact projects in 2021. Instead, Europe takes the lion’s share of ‘use of proceeds’ – $548bn as of end of 2022 – almost four times the investment inflows of the next largest region to benefit, Asia (at $145bn).

What this imbalance between Developing and Developed Markets’ ‘use of proceeds’ for SDG-linked initiatives means is that regions most exposed to the risk of climate change are also those with less means to finance their transitions. That includes both climate change mitigation (e.g. renewable energy solutions) and adaptation solutions (e.g. flood protections).

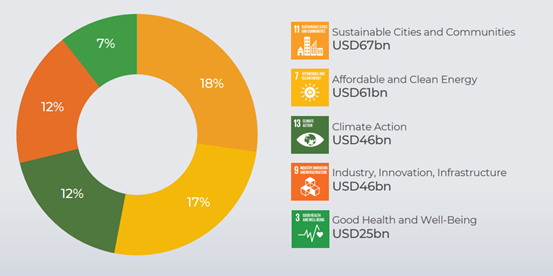

Our GSS Bond report found the most popular SDGs targeted by GSS Bond issuers are related to clean energy, healthcare, and the environment. The 5 most common SDGs in 2022 were present in 46% of frameworks, highlighting a strong focus on few key topics:

GSS Bond Emerging Markets Issuance

While Mexico issued the world’s first sovereign SDG bond, Developing Markets own issuance of GSS Bonds remains a fraction of the rest of the world; accounting for just 9% of the total in 2022. However, this represents an upwards trajectory, tripling the volume of GSS Bond issuances from Developing Markets within seven years (from 2015).

China remains the largest market for GSS Bond issuance in Developing Markets, accounting for over 60% of total issuance since 2015, though the number of issuers has also expanded significantly. Our database sees GSS Bonds issued from 35 Developing Markets as of 2022, compared with eight in 2015.

It is widely believed that in a few years’ time we’ll be left with fossil fuel resources that cannot be burned and fossil fuel infrastructure (e.g. pipelines, power plants) that is no longer used and may end up as a liability before the end of its anticipated economic lifetime. In order to avoid the cost of ‘stranded assets’ in the medium term, Developing Markets must scale policy and investment into sustainable activities.

Conclusion

Green, Social and Sustainability (GSS) Bonds can be deployed as traditional bonds, with the additional feature of deploying capital towards environmental and social projects (the “use of proceeds”).

Providing a mapping between use of proceeds and the SDGs has become an increasingly common practice in the GSS Bonds market, especially within pre-issuance documents published by issuers (e.g. Green Bond Frameworks). In 2022, 63% of GSS bonds provided an explicit SDG mapping in pre-issuance documents, up from just 10% in 2016. This highlights the increasing transparency and maturity of this market.

However, lack of financing remains a major obstacle to achieving the SDGs, and it is most acute in Developing Markets. While GSS Bonds are helping, the number of SDG-linked projects have actually decreased more in Developing Markets than Developed Markets during Covid.

To reiterate, the UN SDGs and Paris Agreement commitments can only be met with considerable contribution from both Developed and Developing Markets. GSS Bonds don’t pretend to offer a panacea, but with more financial instruments available, institutional investors can safeguard long-term investments and scale solutions to narrow that $2.5trn annual funding gap.

By Pietro Sette, Research Director at MainStreet Partners