Annie Omojola, Research Analyst

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Over the past 12 months, we’ve been analysing more than 1,400 funds to understand how asset managers are approaching ESG and Sustainability in practice.

The findings reveal a rapidly maturing market, where traditional exclusion-based strategies remain widespread, but forward-looking sustainability themes and data-driven innovation are gaining ground.

From exclusion to opportunity

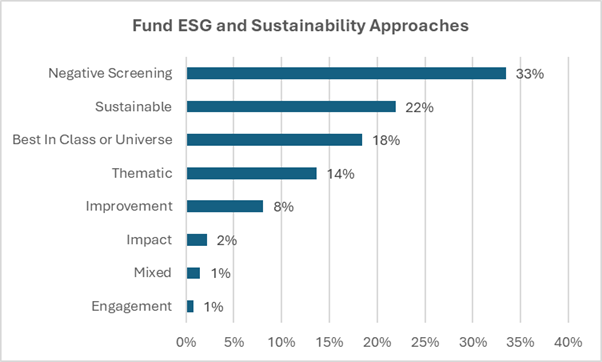

Negative Screening remains the most common approach, adopted by nearly one in three funds.

These products exclude companies involved in controversial sectors providing reputational protection and aligning with minimum investor expectations. This dominance is no surprise; exclusionary screening is one of the oldest and most operationally straightforward ESG strategies. It provides fund managers with a clear framework for limiting reputational risks and meeting the minimum expectations of investors who want to ensure controversial sectors are avoided.

Yet, this strategy is essentially defensive rather than opportunistic. Rather than seeking out new opportunities or promoting positive change, this strategy is focused on avoidance, specifically on what assets not to include in a portfolio. As such, while it is effective in reducing certain risks, it does not actively pursue sustainability outcomes or drive broader impact.

Figure 1: ESG and Sustainability approaches for the universe of over 1,400 funds

In contrast, the Sustainable and Thematic approaches, together representing the second-largest share, reflect a more proactive mindset. These funds target areas such as biodiversity, the circular economy, inclusivity, and energy transition, often aligning with the UN Sustainable Development Goals (SDGs).

Active and passive, two paths to integration

A clear distinction exists between active and passive strategies. More than half of ETFs and index funds are categorised under Improvement or Best-in-Class strategies. This is logical. Optimisation lends itself well here as portfolios can be tilted toward companies with superior ESG scores, low-carbon exposures, or Paris-Aligned pathways.

Active funds, by contrast, tend to focus on Negative Screening and Sustainable categories, where qualitative judgement, narrative building, and conviction-led approaches play a stronger role.

For Asset Managers, this divergence opens two strategic paths: the passive side can enhance their thematic offering beyond score optimisation, while the actives can strengthen their sustainability expertise and expand regional or thematic coverage.

How many funds are truly sustainable? Based on our proprietary framework, not many.

In fact, only 20% of the analysed funds meet the company’s definition of Sustainability. To qualify, funds must show clear sustainability intentionality, governance, stewardship, and targeted sustainability outcomes while avoiding activities that cause significant harm.

Within this group, most take a broad SDGs or multi-thematic approach alongside a focus on environmental and climate-related themes, yet opportunities remain underexplored in areas such as digital inclusion, mobility, and social transition.

Finding sustainability in today’s markets

Figure 2: Sub Asset Class for funds that meet Mainstreet’s definition of Sustainability (In the chart, LC: Large Cap, SMID: Small & Mid Cap, LS: Long Short)

Asset class coverage here tells an interesting story.

Global Large Cap equities dominate the sustainable fund landscape, reflecting both liquidity and investor demand. But the scarcity of sustainable options in areas such as global government bonds, high-yield credit, and emerging market equities is structural.

In high yield, much of the universe is concentrated in sectors like oil and gas, coal, gambling, and heavily leveraged financials which are often excluded by ESG and Sustainable mandates, leaving significantly limiting available investment options..

While sovereign green bond issuance remains small relative to the size of the global government bond market, it is expanding steadily, pointing to long-term growth potential for the asset class.

For equities, emerging markets (and particularly country specific funds e.g. Indian or Chinese equities) face challenges around disclosure, governance, and state ownership. Despite this, their central role in the energy transition from renewable capacity to EV supply chains and green infrastructure, makes them a compelling long-term opportunity. However, improving disclosure and rising investor demand for diversification could gradually open these segments.

The road ahead

ESG and Sustainability investing is entering a new phase. Exclusions will continue to set a baseline, but differentiation will increasingly depend on innovation, across themes, asset classes, and regions.

For asset managers, the message is clear. Sustainability is no longer just about risk management; it is about value creation. The next generation of sustainable funds will be defined not by what they exclude, but by what they enable.